HOA financial management is one of the most vital components of a successful community association. It goes beyond collecting dues—it’s about budgeting, reporting, auditing, and maintaining a healthy reserve fund. Whether your association is self-managed or partners with a professional management company, understanding the basics of HOA accounting and financial planning is essential. In this guide, we’ll walk through budgeting tips, reserve strategies, financial reports, and common pitfalls to avoid to keep your HOA finances healthy.

The Foundation of Effective HOA Financial Management

Strong financial management starts with clear policies, defined Board roles, and a commitment to transparency. HOA Boards must establish internal controls to reduce the risk of fraud and create consistency in financial operations. Assigning a dedicated treasurer, forming a finance committee, and using HOA accounting software ensures accurate reporting and better compliance.

Establishing written financial procedures for handling accounts payable, dues collection, and reporting timelines builds accountability. Transparency fosters homeowner trust, especially when financial information is shared regularly through portals, emails, or meetings.

Annual Budget Planning for HOAs

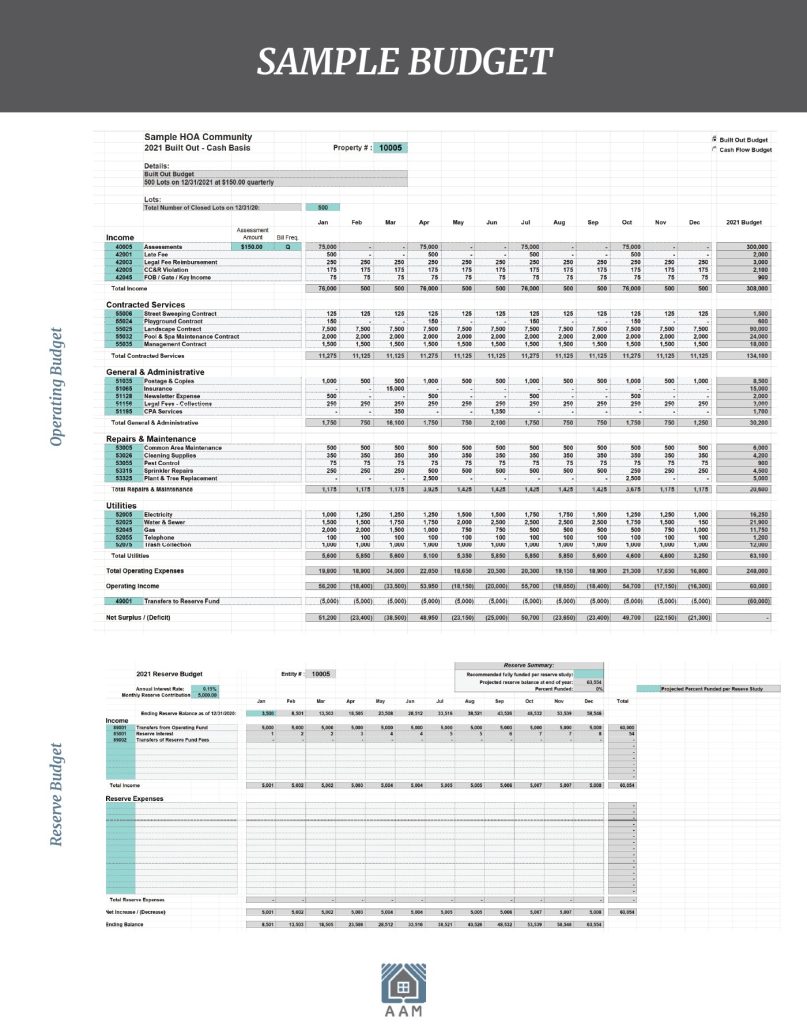

Creating an annual HOA budget is more than a numbers game—it’s a strategic process that reflects the community’s values. Your HOA’s budget should cover recurring expenses, long-term maintenance, reserve contributions, and contingency funds. Begin budget planning early, involving vendors, community input, and historical data.

Key elements of successful HOA budgeting include:

- Breaking down operating expenses by category

- Including line items for landscaping, insurance, utilities, and legal fees

- Allocating adequate contributions to reserves

- Planning for inflation or vendor increases

Regularly comparing actual financial performance to the budget ensures your community stays on track throughout the year.

HOA Reserve Fund Planning and Requirements

Reserves are a cornerstone of long-term HOA financial stability. The association uses the reserve fund to repair or replace major common elements, such as roads, roofs, and pools. Conducting a reserve study every 3 to 5 years is considered a best practice in the industry. These studies help Boards determine how much to save annually.

Reserve fund planning includes:

- Following the recommendations in your most recent reserve study

- Setting a percentage goal for funded status (70 %+ is ideal)

- Separating operating and reserve accounts to avoid misuse

Failure to fund reserves properly can result in special assessments or deferred maintenance, both of which can negatively impact homeowner satisfaction and property values.

Key HOA Financial Reports Explained

Every Board member should understand the basic HOA financial statements. These documents reveal the community’s financial health and help support responsible decision-making.

- Balance Sheet – Lists the association’s assets, liabilities, and equity.

- Income Statement (Profit & Loss) – Tracks revenue and expenses over a specific period.

- General Ledger – Provides a detailed view of every financial transaction.

- Aged Delinquency Report – Shows overdue homeowner accounts.

- Bank Reconciliation Report – Confirms that bank statements match recorded transactions.

Boards should review these reports monthly and include them in Board meeting packets. Many states require associations to share this information with homeowners on a quarterly or annual basis.

HOA Audits and Financial Reviews

AAM is proud to have engaged in the SOC 1 (SSAE 18) audit, which reflects our commitment to financial integrity, internal controls, and industry-leading operational standards. This independent audit ensures that our clients can trust the accuracy and consistency of our financial reporting systems.

In addition to internal reviews, many HOAs benefit from annual financial audits or third-party reviews by a CPA. These assessments verify compliance with GAAP (Generally Accepted Accounting Principles), detect errors, and reinforce trust. Governing documents or state law may require larger communities to conduct an audit annually.

Common HOA Financial Mistakes to Avoid

Even experienced HOA Board members can make financial decisions that seem minor but result in long-term challenges. Below are common mistakes associations face when managing their community’s finances, and actionable ways to fix them while maintaining accurate financial records and reducing the risk of unexpected expenses.

- Failing to follow the budget or update it annually

- Neglecting reserve funding

- Not enforcing collection policies consistently

- Using outdated or manual accounting systems

- Lack of separation between operating and reserve funds

- Overlooking proper documentation

- Inadequate vendor oversight

Avoiding these mistakes helps your HOA operate smoothly and improves transparency with homeowners. If your Board struggles with any of these issues, partnering with a firm that offers professional financial management services may be the best next step.

When to Hire a Professional HOA Management Company

Managing HOA finances requires time, skill, and consistency. If your Board is experiencing burnout, making frequent financial errors, or receiving increased homeowner complaints, it may be time to consider professional management.

Here are signs your HOA could benefit from expert help:

- Repeated budget shortfalls or unexplained variances

- Missed deadlines for financial reports or tax filings

- High delinquency rates with no collection strategy

- Lack of transparency or homeowner trust in financial decisions

- Unfamiliarity with HOA laws, GAAP, or tax requirements

- Difficulty maintaining accurate and accessible records

- Infrequent or outdated reserve studies

- Board Members’ fatigue or lack of financial experience

Partnering with a management company brings:

- Professional HOA accounting software

- Access to experienced finance and compliance professionals

- Standardized financial procedures

- Risk reduction and better reporting accuracy

Financial Transparency and Homeowner Communication

Today’s homeowners expect timely and clear updates about how their assessments are being used. Sharing quarterly financial summaries, providing access to an owner portal, and including budget overviews in newsletters helps build credibility.

Boards should also be prepared to answer common questions like:

- Why did assessments increase?

- What happens if reserves are underfunded?

- How are delinquent payments handled?

Being proactive in communication prevents misunderstandings and enhances community relationships.

Next Steps for Strengthening Your HOA’s Financial Health

If your Board is ready to improve its financial management process, start by:

- Reviewing your reserve study and funding level

- Auditing your current budget for accuracy and transparency

- Establishing or updating financial policies and procedures

- Scheduling monthly Board-level financial reviews

- Consulting with a CPA or management professional for deeper insight

At AAM, we offer tailored HOA financial management services designed to support your community’s unique needs. From accurate accounting and transparent reporting to reserve planning and audits, we’re here to help Board Members lead with confidence.